Genneral summary

Health is the most valuable asset of every individual, and we always seek the best and most superior solutions to protect and improve our health conditions. As the socio-economic landscape advances, the demand for medical check-ups and treatments is increasing steadily. Therefore, alongside the preparation of a mandatory state-regulated health insurance card, many individuals nowadays opt to acquire voluntary health insurance cards for themselves and their loved ones. This serves as an insurance service that enables participants to easily access better medical services, especially when conventional health insurance falls short of meeting the needs for medical consultations and treatments for patients.

What is health insurance?

Health insurance is one of the insurance programs falling under the category of non-life insurance, and this product is considered a solid financial foundation when you or your family unexpectedly encounter health-related risks or incidents. Accordingly, health insurance will assist in covering a portion or the entirety of the treatment expenses at medical facilities (included in the list of hospitals and clinics affiliated with the insurance company) when the insured individual faces health issues.

Especially in the current situation, medical expenses for treatment, recovery, and healthcare are exponentially increasing, alongside a growing number of people being afflicted with illnesses and patients seeking medical consultations and treatments at both public and private hospitals and clinics. At this juncture, a health care insurance card will facilitate your easy selection of healthcare providers, reducing fees for consultations, medical tests, prescription medications, room charges, and more. This grants you peace of mind during your treatment and recovery. Notably, as a form of voluntary insurance, health insurance often provides higher coverage limits and payouts compared to regular health insurance. Additionally, in many cases, the scope of this insurance product extends beyond national boundaries, allowing access to overseas medical services during special or urgent situations.

Information about some products

Bao Viet An Gia

Bao Viet An Gia’s health insurance product is a product that many customers care about and choose a lot. Some highlights of this product

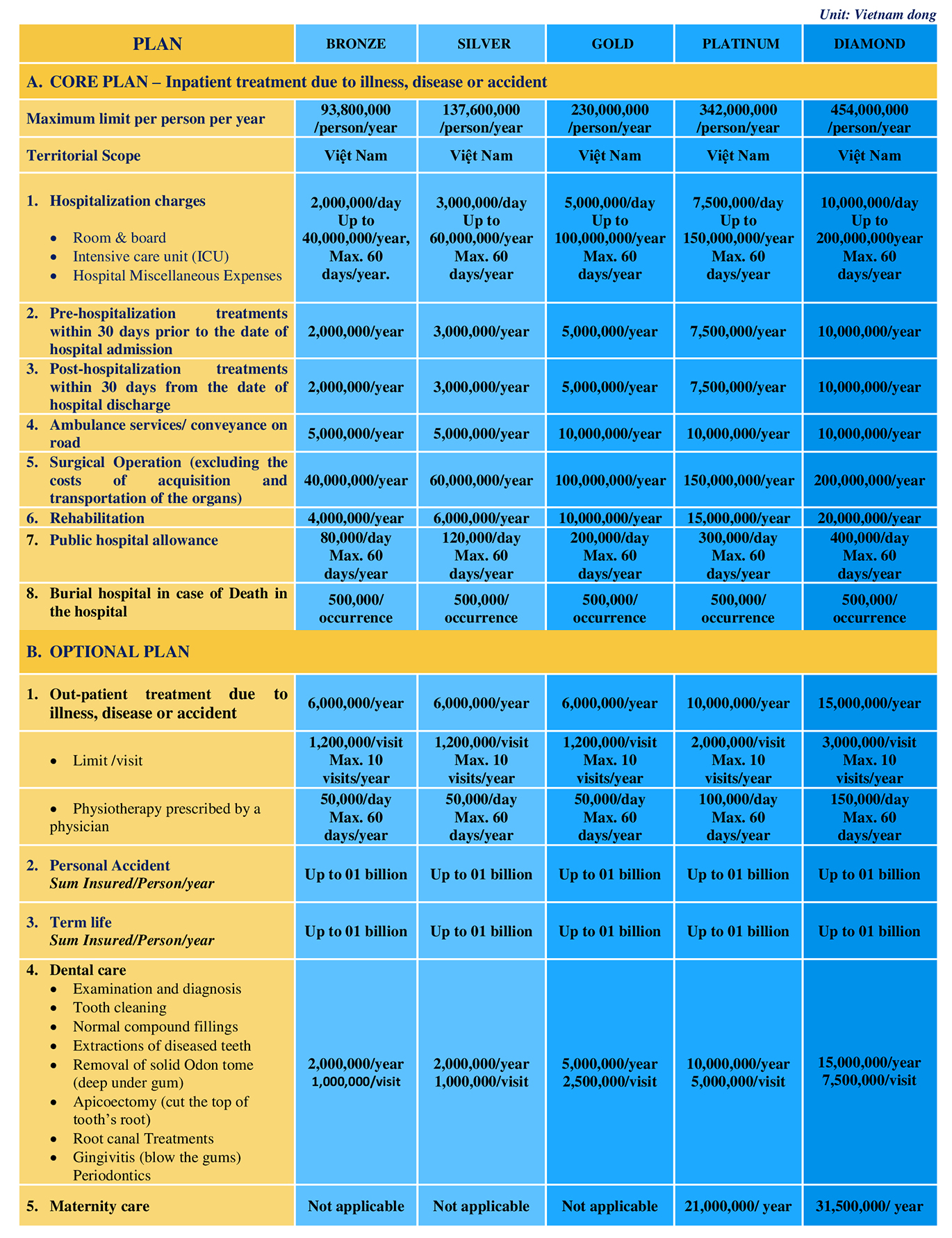

Bao Viet An Gia health insurance brings you 5 health insurance plans with outstanding benefits, best meeting the health care needs of you and your family.

- Basic benefits up to 454,000,000 VND/person/year

- No pre-registration medical examination required

- Optionally choose a medical facility

- Comprehensive Direct billing network

- Trusted by many people

Features of Bao Viet An Gia:

– Subjects of insurance: All citizens and foreigners residing in Vietnam from 15 days old to 60 years old, renewing to 65 years old

– Scope of territory: Vietnam

– Main insurance benefits: Inpatient treatment due to illness, disease, accident including pregnancy complications

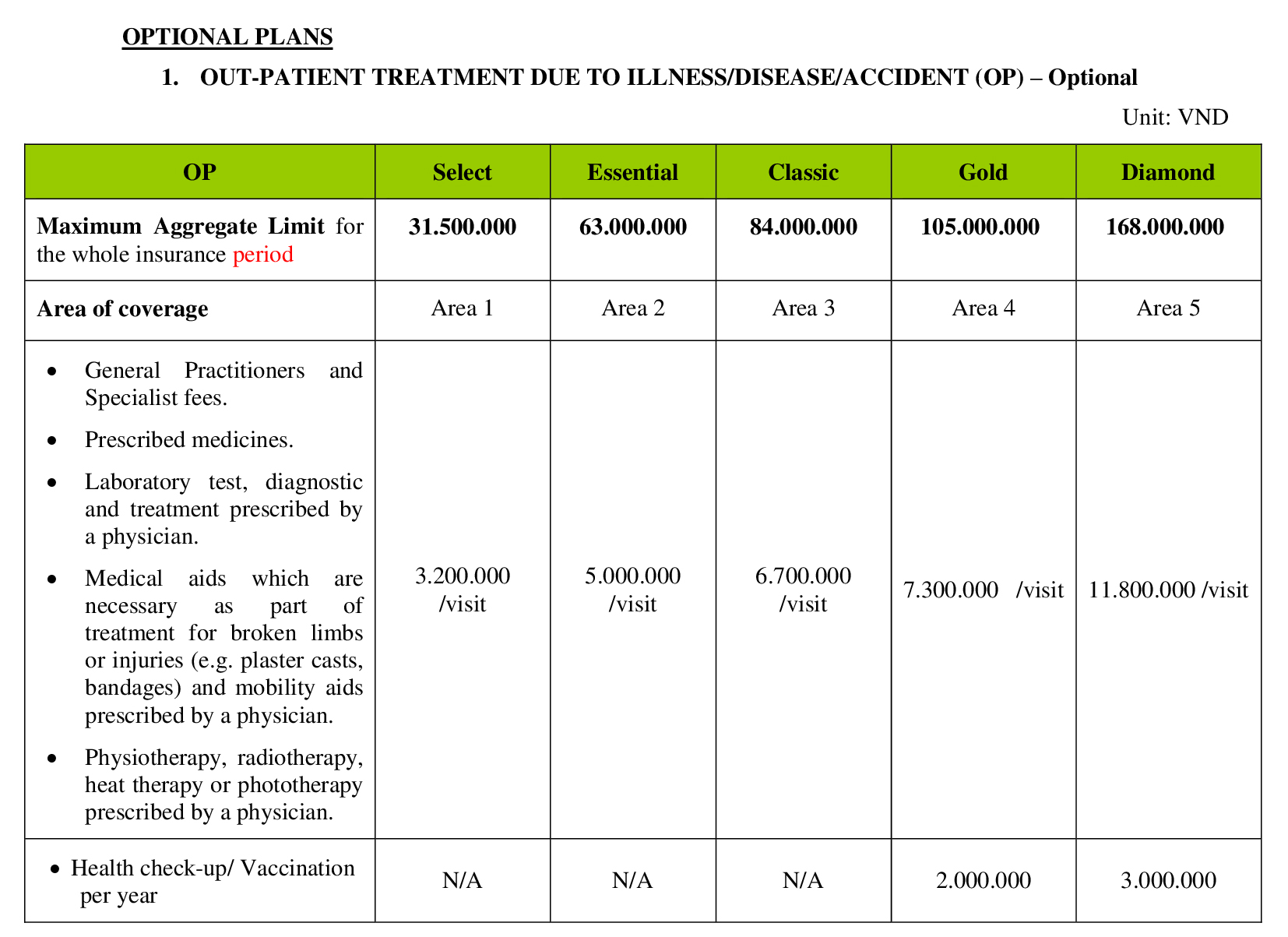

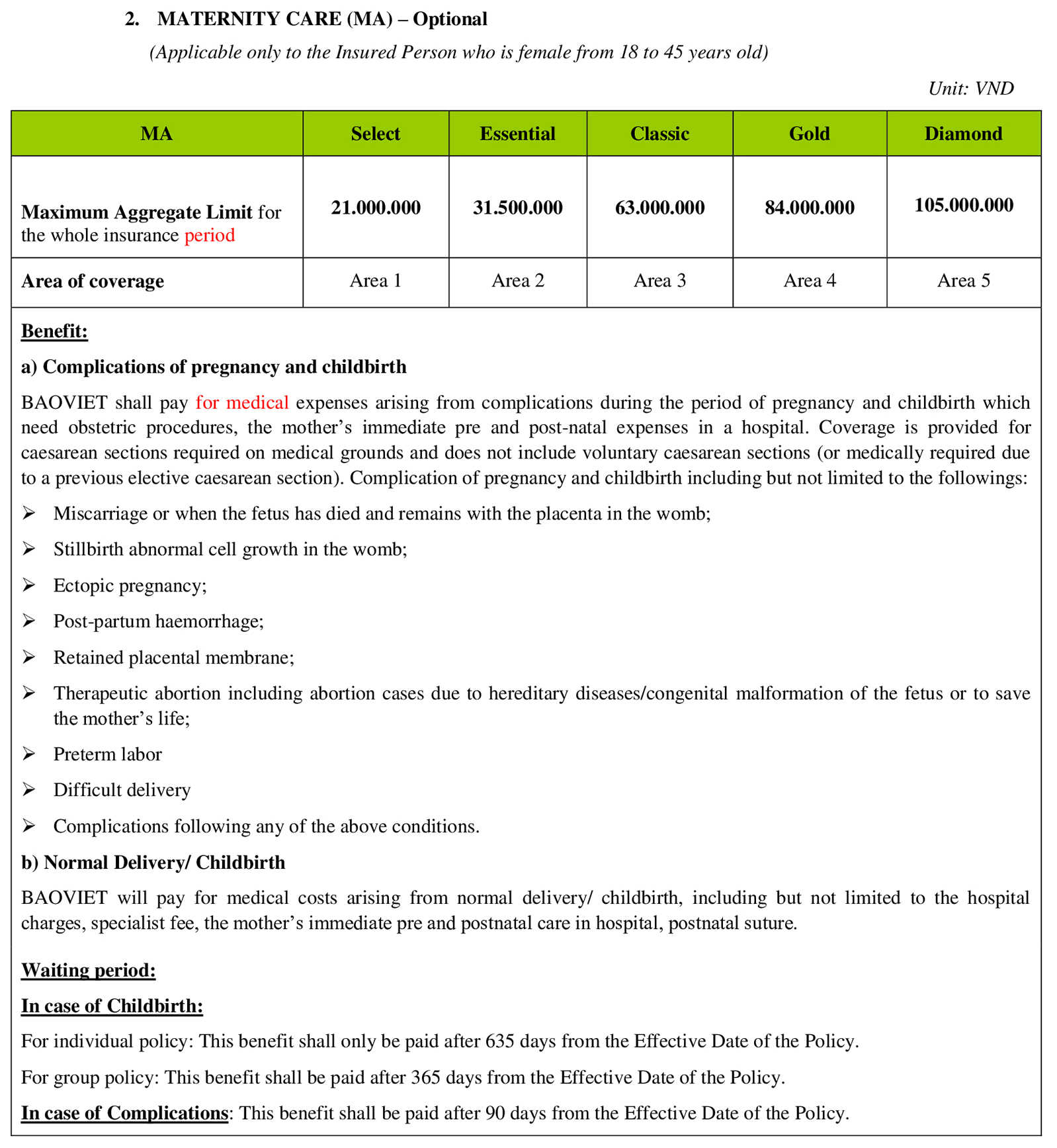

Additional benefits: Outpatient treatment due to illness, disease, accident including maternity complications

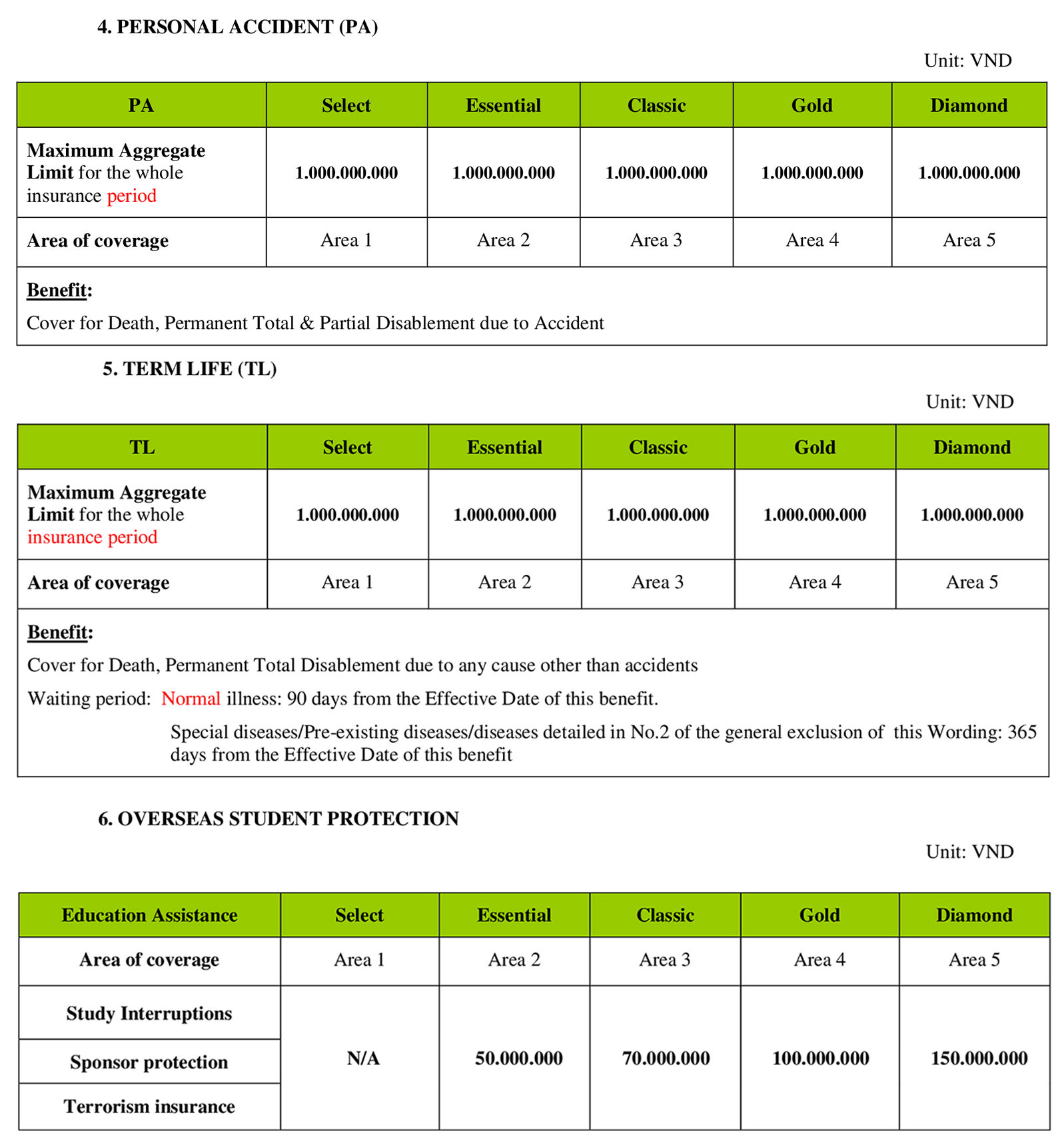

- Personal Accident

- Term Life

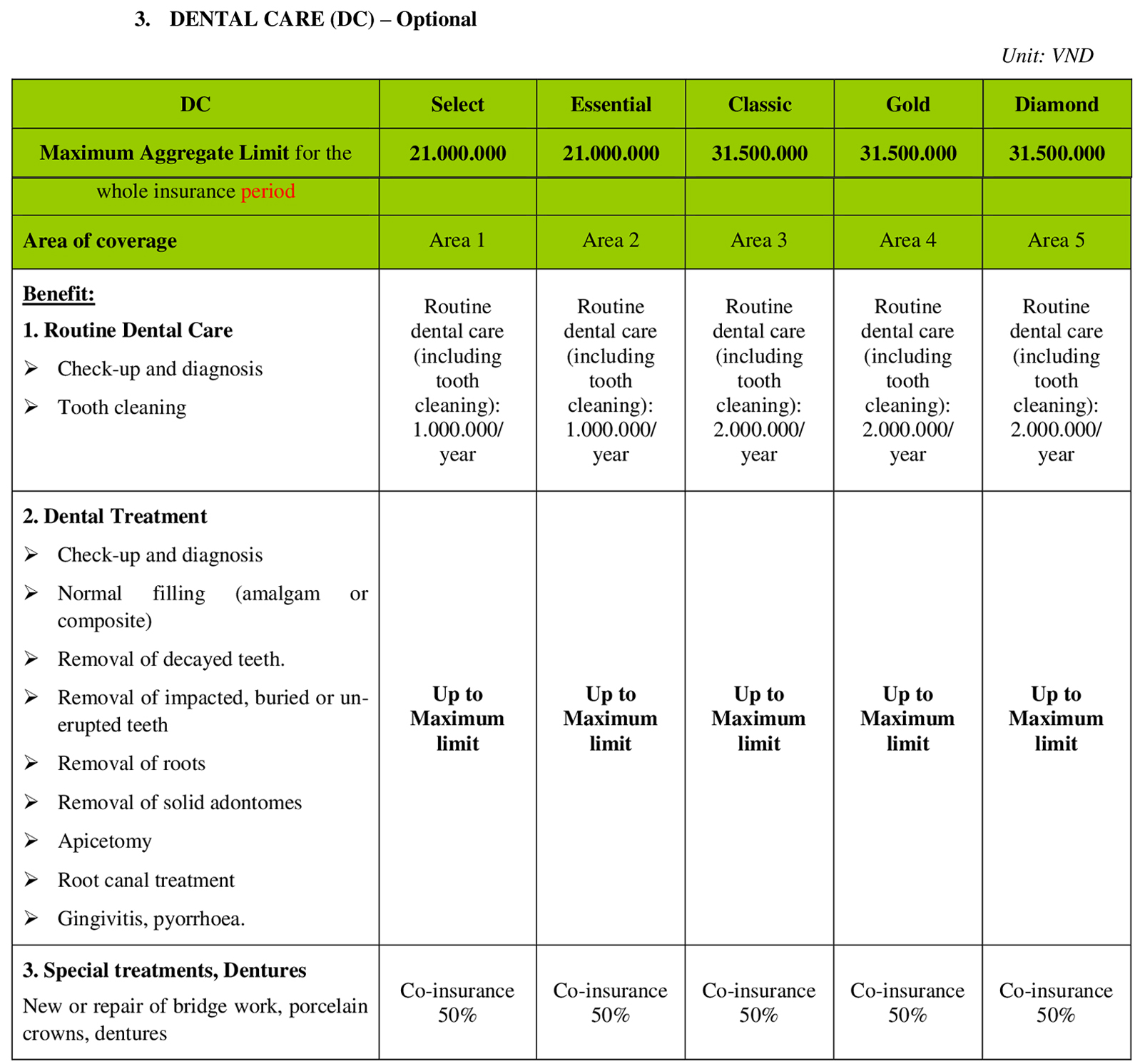

- Dental Care

- Maternity care

Participation Procedures:

Complete and provide the insurance request fully and truthfully.

Children joining with parents: Their coverage cannot exceed that of their parents’ insurance program and must be accompanied by a birth certificate.

All insurance benefits will remain unchanged throughout the insurance period.

Benefit table

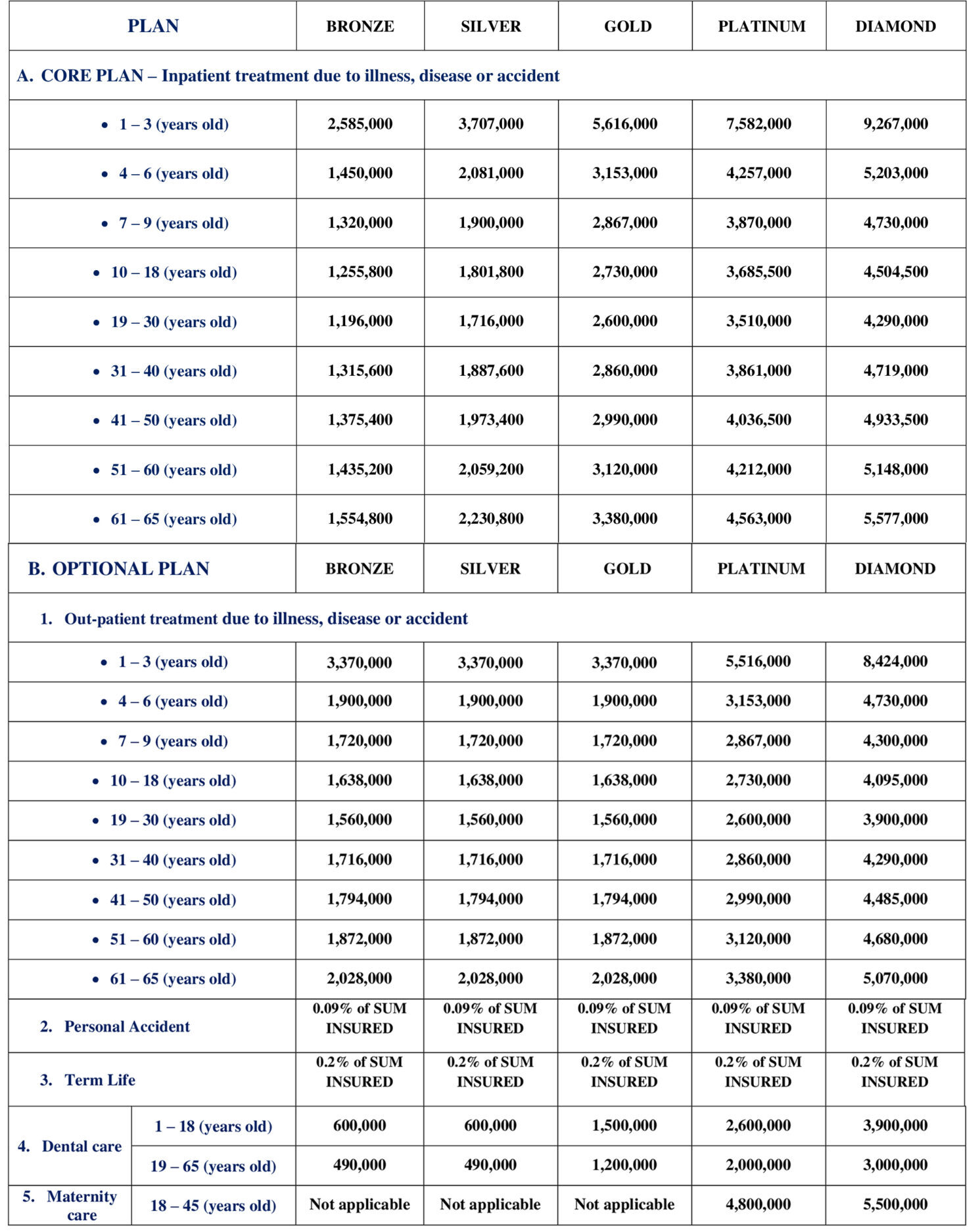

Premium table

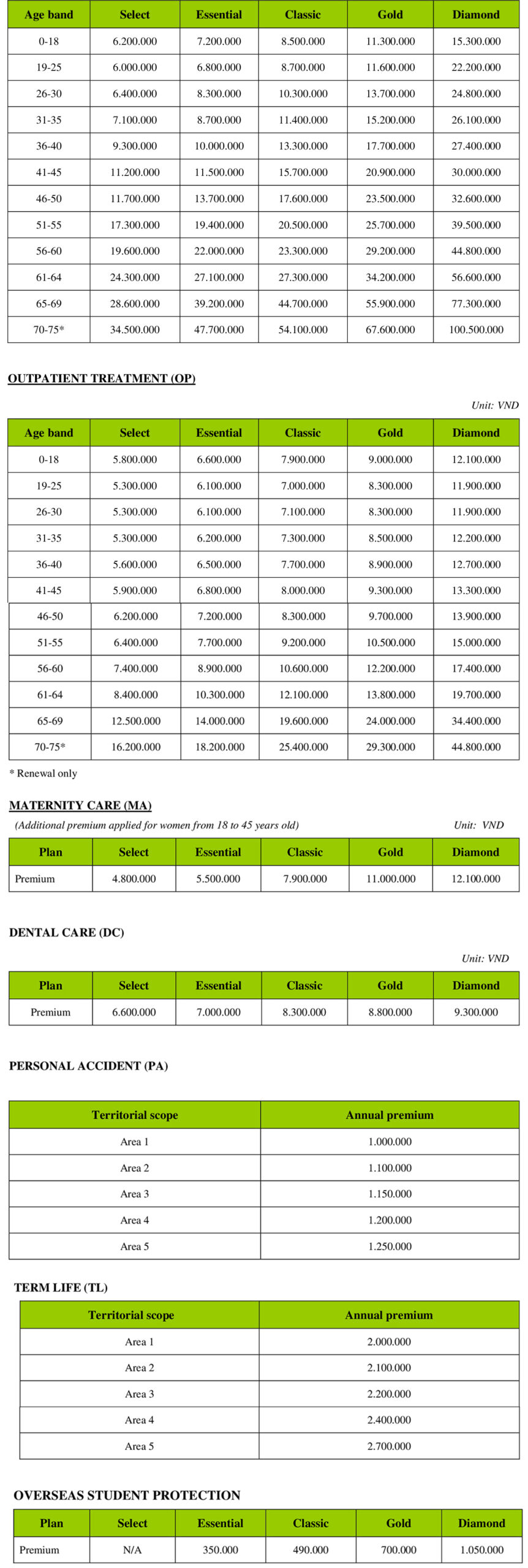

Bao Viet Intercare

Next is a highly prestigious product in the market provided by Bao Viet Insurance, and commanding the attention of numerous clients. Bao Viet Insurance proudly presents the “Bao Viet Intercare Insurance” – a premium healthcare insurance program with the desire to serve and share with all valued customers the difficulties posed by unexpected risks in Vietnam or abroad.

This is a high-end healthcare insurance product, designed to cater to individuals with special healthcare needs. When customers participate in this insurance, they receive the most comprehensive medical protection, enjoying the quality of premium healthcare services at leading hospitals in Vietnam and abroad.

Participants in the insurance program include:

- The insured are all Vietnamese citizens and foreigners living legally in Vietnam, including overseas Vietnamese students.

- The age of insurance coverage is from 15 days old to 69 years old for new purchases and 75 years old for renewals.

- The insured are all Vietnamese citizens and foreigners living legally in Vietnam, including overseas Vietnamese students.

- The age of insurance coverage is from 15 days old to 69 years old for new purchases and 75 years old for renewals.

- The insured are all Vietnamese citizens and foreigners living legally in Vietnam, including overseas Vietnamese students.

- The age of insurance coverage is from 15 days old to 69 years old for new purchases and 75 years old for renewals.

Some highlights

- No health check required before enrollment.

- Insurance benefits coverage up to 10 billion VND, providing you and your family with the option to seek medical consultations and treatments at premier healthcare institutions such as FV Hospital, Franco-Vietnamese Hospital, Viet Duc Hospital, Vimec Hospital, and other top-tier hospitals in Vietnam, as well as leading medical facilities in the region and around the world. • Covers both inpatient and outpatient expenses.

- Diverse insurance benefits suitable for various budgets and needs: inpatient and outpatient medical treatment coverage for illness/accidents, personal accident insurance, life insurance, dental insurance, maternity insurance, study-abroad student support, and more.

- Extensive insurance benefits, including emergency medical transportation and repatriation coverage.

- Numerous benefit options and coverage limits for customers to choose from.

- Insurance coverage spanning regions from Vietnam, Southeast Asia, Asia, and Worldwide excluding the United States & Canada. • Reimbursement of up to 100% of the insured amount.

- Waiting period of 30 days for lung inflammation, bronchitis, and bronchiolitis, applicable to all age groups.

- Transparent, swift, and professional claims handling service.

Coverage

Bao Viet INTERCARE coverage is up to the whole world and the programs have specific coverage as follows:

Area 1: VIETNAM

Area 2: ASEAN

Area 3: ASIA

Area 4: WORLDWIDE EXCLUDING USA AND CANADA

Area 5: WORLDWIDE.

Premium table

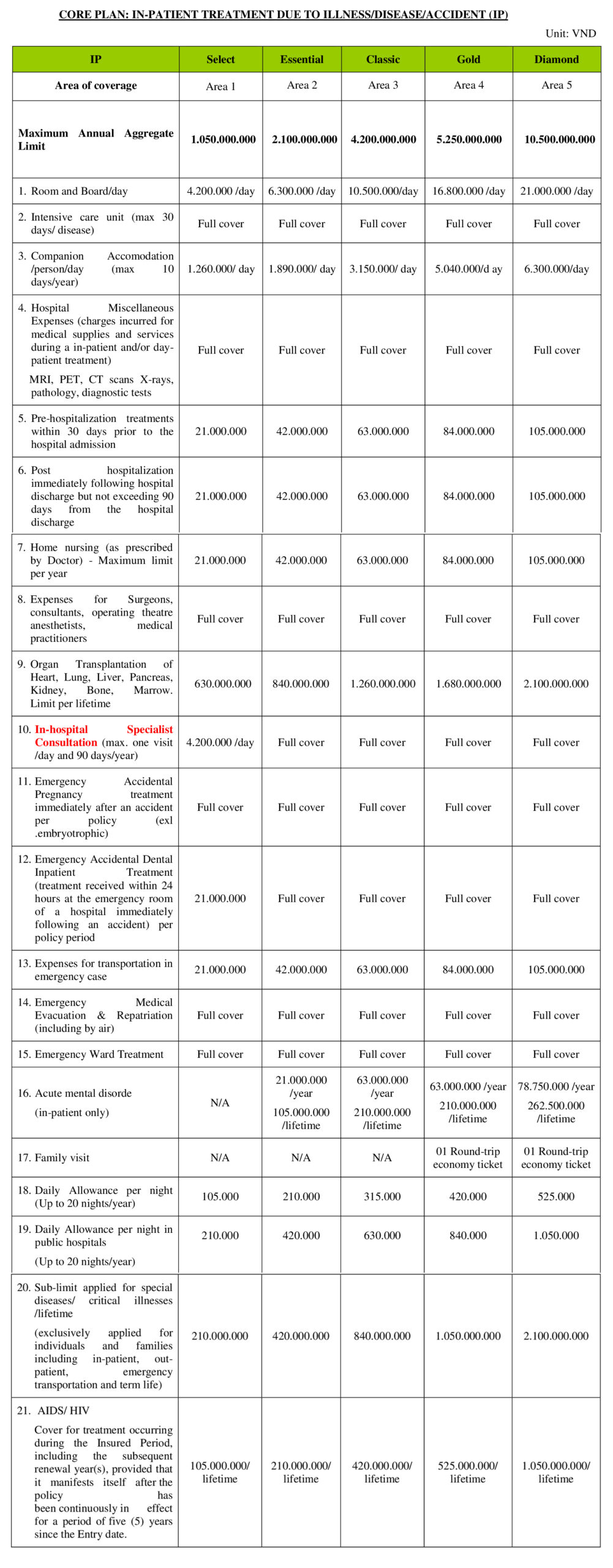

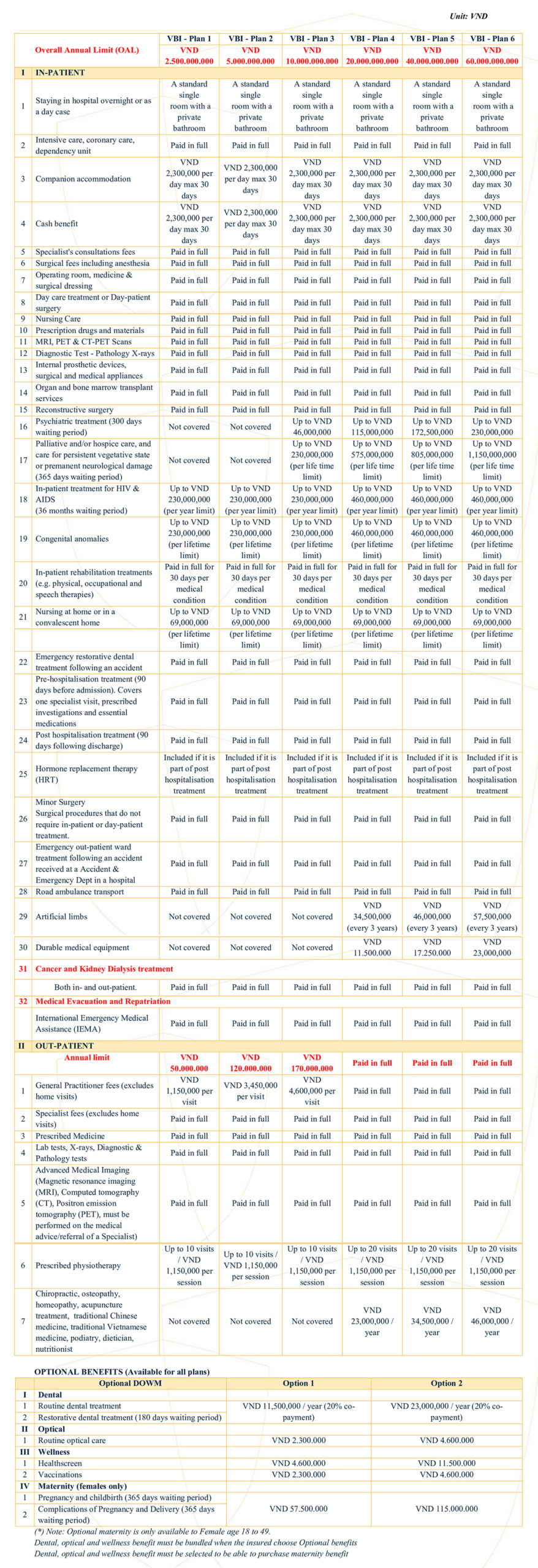

Benefits table

Some definitions

Area of coverage

Area of coverage is stated in the Benefit Schedule, including which the Insured Person can be evacuated to in the event of medical emergency when necessary treatment is unavailable locally and where the customary and necessary medical expenses incurred by the Insured Person may be considered payable under this Policy.

Accident

Any sudden and unforeseen event occurring during the Insured Period by an external, violent and visible force is considered as a cause resulting in Bodily Injury or Death of the Insured Person and occuring beyond the Insured’s control.

Bodily injury

Any injury caused solely by an accident during the Insured Period results in the Insured’s disability or disablement.

Partial permanent disablement

Shall refer to any Disablement listed in Table of Disability Percentage attached to the Policy or Bodily Injury solely due to accident which permanently and considerably reduces the Insured person’s working capacity as a result of the removal or loss/loss of use/paralysis of any part of the Insured person’s body, provided that such Disablement/Injury is unable to be improved in current medical practice and lasts 52 consecutive weeks.

Total permanent disablement

Shall refer to any Disablement which entirely and permanently prevents the Insured Person from attending to any Business or Occupation of any and every kind, or causes entire loss of the Insured person’s working capacity for any type of work, provided that such disablement lasts 104 consecutive weeks and is beyond hope of any improvement thereafter.

Illness, disease

Shall refer to a physical condition marked by a pathological deviation from the normal healthy state, which manifests itself in symptoms or syndromes diagnosed by Physicians.

Accute condition/illness

A medical condition is characterized by signs and symptoms of rapid onset and short duration and can be cured.

Chronic condition/illness

A medical condition determined by a licensed Physician as a General Practitioner or Medical Specialists or Consultants is long-lasting in its effects, persistent and cannot be cured.

Pre-existing condition

Any medical conditions of the Insured Person which have been diagnosed; or for which symptoms existed that would cause an ordinary prudent person to seek diagnosis, care or treatment; or for which medical treatment was recommended by a medical practitioner, irrespective of whether treatment was actually received or not.

Special disease

Under this Policy, the following diseases are understood as special diseases:

Cancer and tumors of any kind

- Diseases of heart, liver (hepatitis A, B, C), pancreas, kidney, lung failure

- Diseases related to hematopoietic (blood forming) system including pancreatic failure, acute and chronic leukemia.

- Growth hormone deficiency

- Diabetes mellitus

- Parkinson’s disease.

VBI PREMIER CARE

Characteristics:

Age Eligibility: Participation age ranges from 15 days to 70 years old, with the option to renew up to 84 years old. Children under 10 years old must be accompanied by a parent.

Primary Country of Residence: Residing in Vietnam for a minimum of 185 days before departing from Vietnam is a prerequisite.

Waiting Period

- 180 days for Dental Rehabilitation Treatment

- 300 days for Mental Health Treatment

- 365 days for Mild Care and/or End-of-Life Care, and Permanent Vegetative State/Permanent Nervous System Damage Care

- 365 days for Pregnancy and Childbirth

- 356 days for Complications during Pregnancy and Postpartum

- 36 months for Inpatient Treatment for HIV/AIDS

List of Guarantee Providers In Vietnam: 270 healthcare facilities

Abroad: Over 1.3 million healthcare facilities

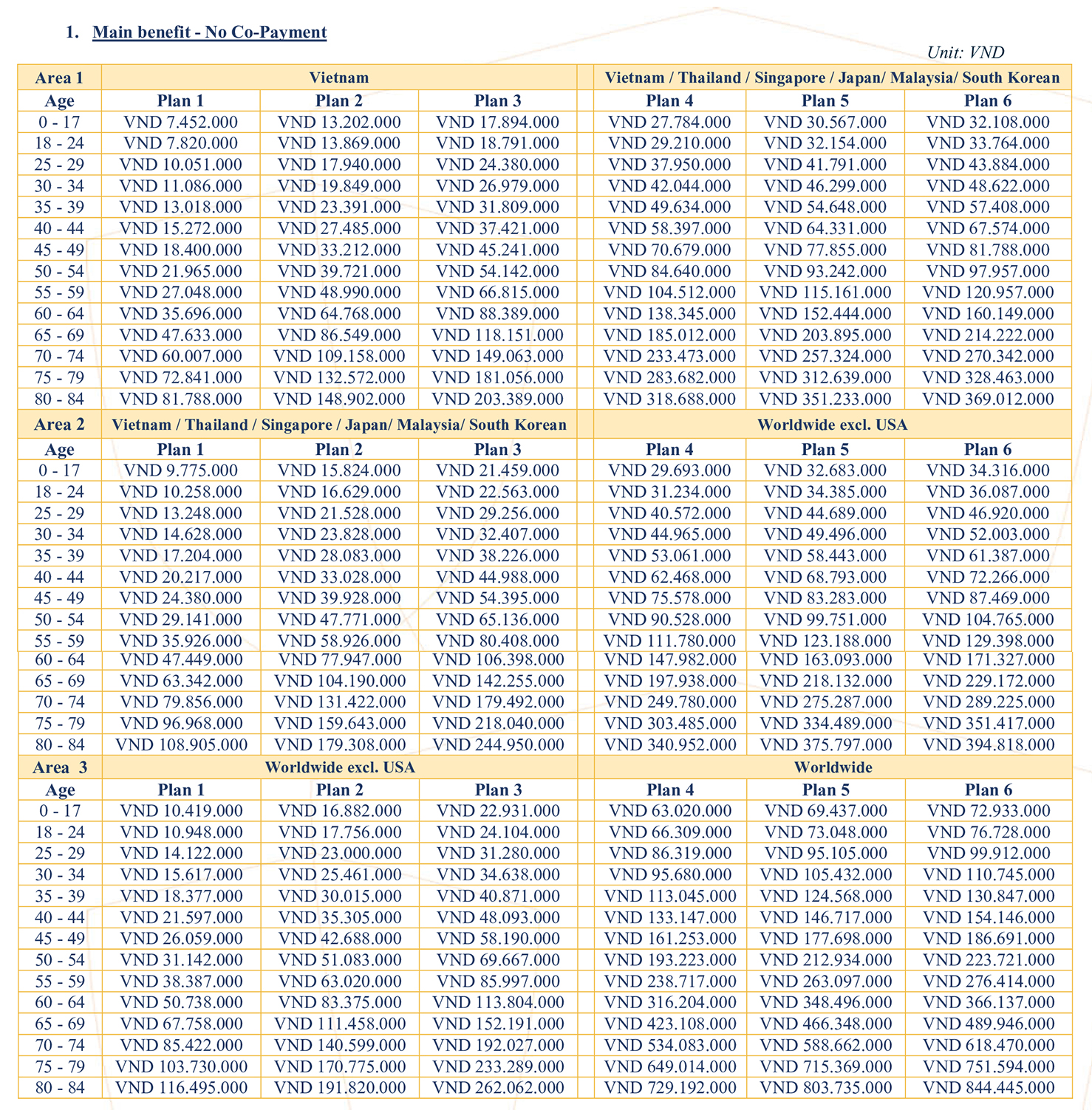

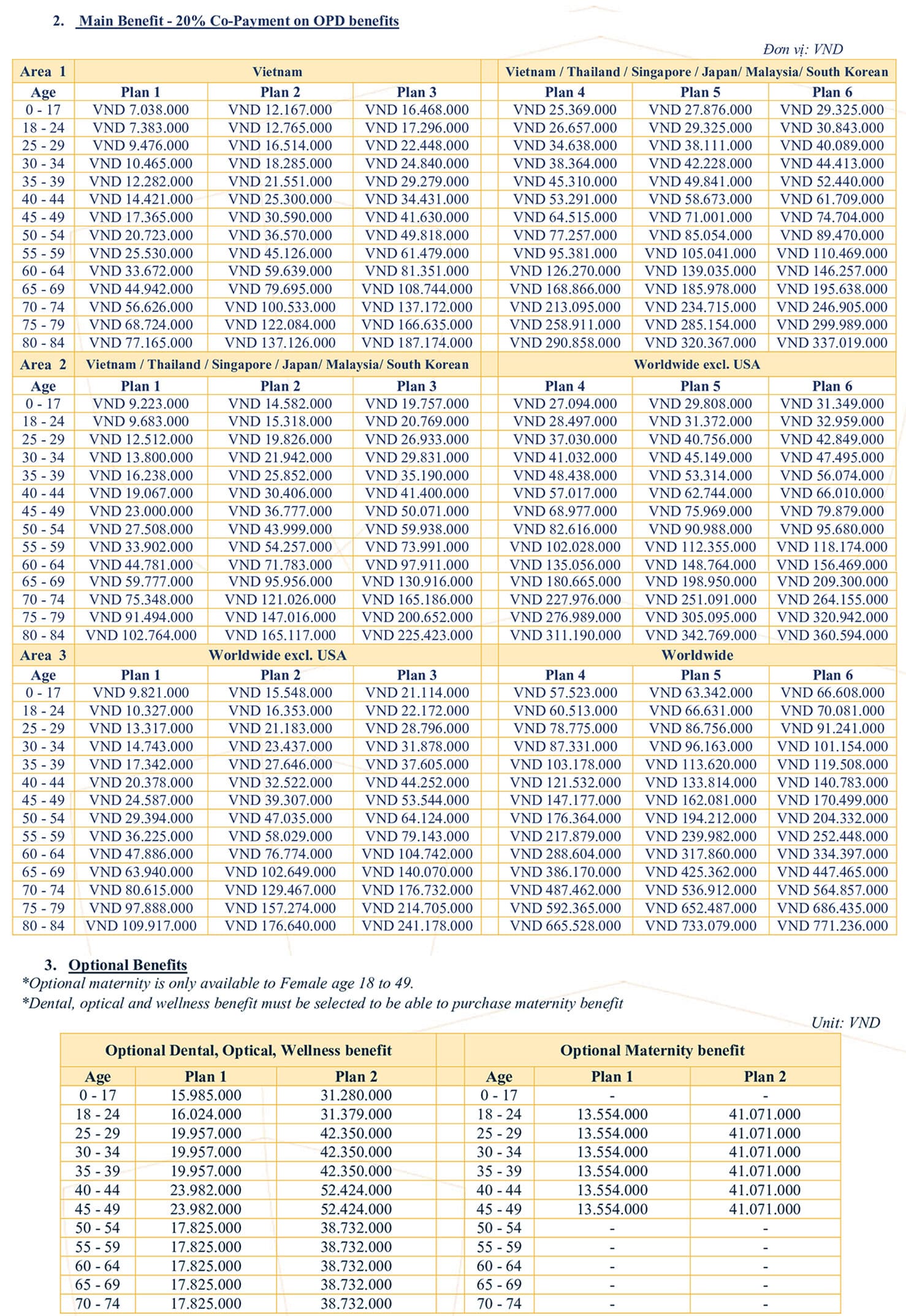

Premium table

- Main benefit – No Co-Payment

Premium table

Contact and Consultation

After you have familiarized yourself with the product and if you require consultation or wish to purchase insurance, please follow these steps:

Option 1: Send inquiries or information through the forms provided on the article or website.

Option 2: Call or text the hotline numbers: 0966 490 888 – 02466 569 888 to speak with our advisors and have your queries addressed.

Option 3: Send an email request to the address: kinhdoanh@ibaohiem.vn, specifying the nature of your request for consultation or clarification. Note: Kindly include your phone number for swift and convenient communication with our consultants.

Option 4: Send a Viber or Zalo message to the phone number: 0966 490 888, stating that you require assistance or consultation.

We are here to assist you promptly and efficiently in whichever way is most convenient for you.

![]()

ĐĂNG KÝ TƯ VẤN MIỄN PHÍ

Gửi thông tin ngay, nhận tư vấn miễn phí